What is a Group?

- In Tally Prime, a "group" is a category of accounts. Similar types of accounts are kept in a group. The main purpose of this is to categorize financial information properly.

Example:

Both 'Cash' and 'Bank' accounts come under the group 'Current Assets'.

Importance of Groups in Tally Prime

- With the help of groups, business financial transactions can be presented systematically. Using these categories, we can get information instantly.

Why use groups?

- Easy categories

- Fast reporting

- Suitable data for tax filing

- Analysis of expenses/income

Predefined groups in Tally Prime

- Tally Prime has 28 predefined groups. Some of the important groups are as follows:

Group Name Type

- Capital Account Capital

- Loans (Liability) Liability

- Sundry Debtors Asset

- Purchase Accounts Expense

- Sales Accounts Income

What is Primary Group?

- These are groups that directly represent the main category. Example: Capital Account, Current Liabilities.

What is a secondary group?

- These are subgroups that fall under the main group. Example: Duties & Taxes (under Current Liabilities).

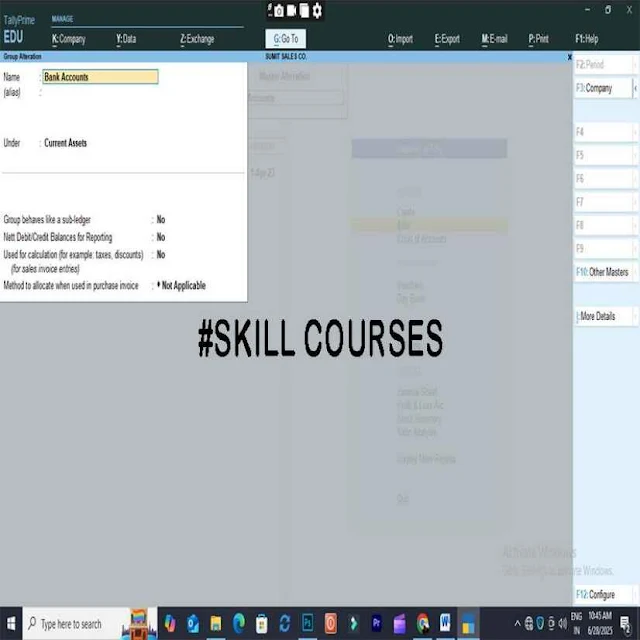

Group Creation Process

Steps:

- Gateway of Tally > Accounts Info > Groups > Create

- Enter a name

- Under: Select the main group

- Fill in the applicable settings

- Accept

Things to be taken care of while creating a group

- Give a suitable name

- Select the appropriate ‘Under’ group

- Avoid duplicate groups

- Understand the Business Structure

Difference between main group and sub-group

| Subject | Main Group | Sub-group |

|---|---|---|

| Location | At the top level | Within the main group |

| Use | For broad category | For specific category |

| Example | Current Assets | Bank Accounts |

Example while creating a new group

- Suppose we want to create a group named “Digital Marketing Expenses”:

- Name: Digital Marketing Expenses

- Under: Indirect Expenses

- Nature: Expense

- Accept

Classification of Groups

In Tally, groups are mainly classified into 2 categories:

- Capital Nature

- Revenue Nature

Revenue and Capital Nature Groups

- Capital Group Revenue Group

- Fixed Assets Indirect Expenses

- Capital A/c Direct Incomes

- Loans Indirect Incomes

Real Estate and Liabilities Groups

- Fixed Assets:

- Office Building

- Machinery

- Liabilities:

- Loans

Creditors

Expenses and Income Groups

- Direct Expenses: Raw Material, Labour

- Indirect Expenses: Rent, Advertising

- Direct Income: Sales

- Indirect Income: Commission Received

What are Stock Groups?

- Stock groups are used to group similar items together. This makes stock management easier.

Benefits of creating stock groups

- Categorizing items

- Easier reporting

- Clear stock values

Use of groups in reporting

- Group wise trial balance

- Group wise profit and loss

- Group wise expense analysis

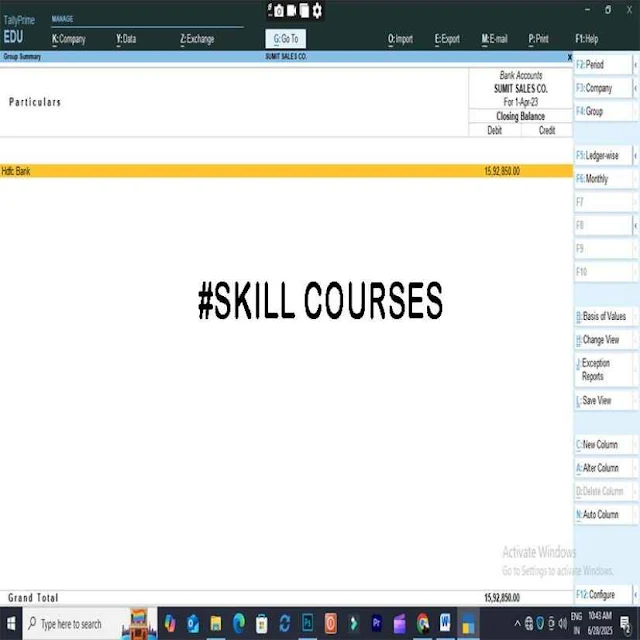

Group wise report in Tally

- Gateway of Tally > Display > Account Books > Group Summary

Analysis with the help of groups

- Which area has more expenses?

- Which income is stable?

- Which loan is more?

Importance of Groups for GST

- GST Classifiable Accounts

- Tax Liability Track

- Input/Output Reports

How to change groups

- Gateway of Tally > Accounts Info > Groups > Alter

- Make necessary changes and ‘Accept’

Process to delete a group

- Can be deleted only if it is not used in the account

- Gateway of Tally > Accounts Info > Groups > Delete

Group wise comparison

- Comparison of the same business over different periods

- Control over increase/decrease in expenses

Group management by industry

- Industry major groups

- Production Direct Expenses, Finished Goods

- Services Indirect Expenses, Income

- Retail Purchases, Sales, Stock

Conclusion

Groups in Tally Prime are a very essential feature. Using them, you can keep your accounting system disciplined, fast and consistent. Proper grouping makes the analysis of financial reports more effective.

Also Read:

.jpg)

0 Comments